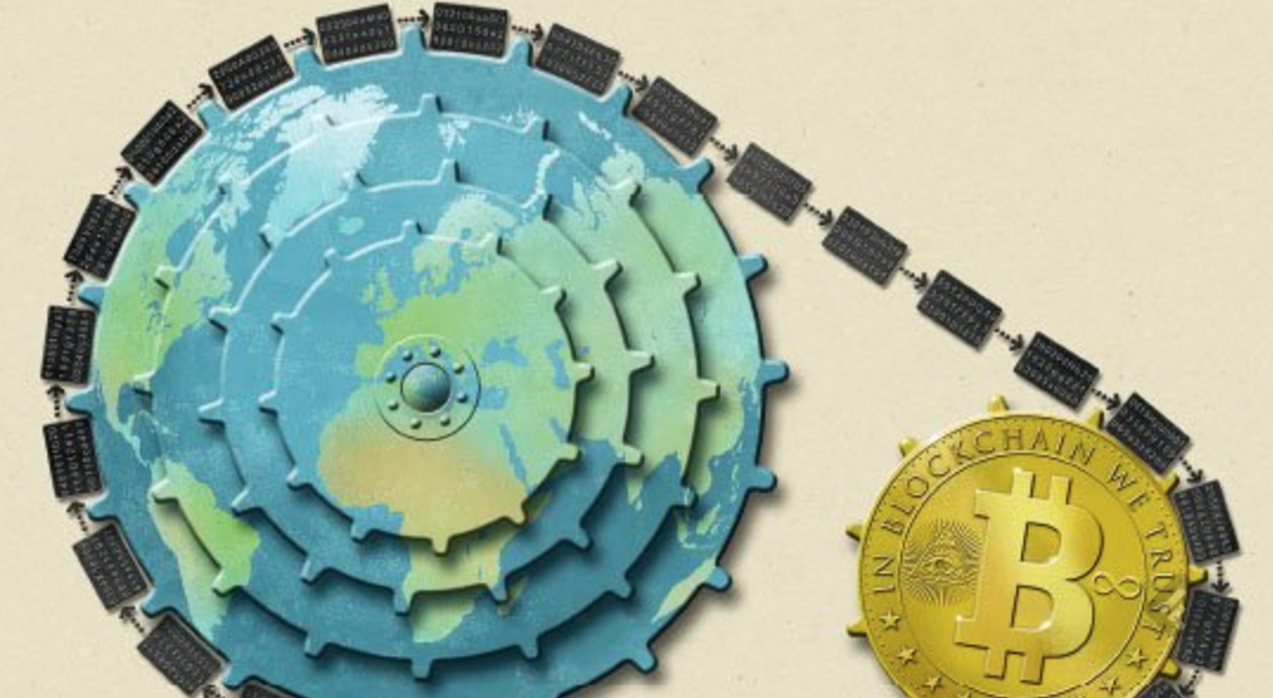

The economist bitcoin trust machine

Contents:

The biggest revolution that blockchain is bringing along may be the possibility of building new ecosystems where participants are rewarded by the extent of their participation. Such examples are being developed by companies like the electric car manufacturer BYOD, where the driver of their electric cars is rewarded in carbon credits that can then be exchanged for good or services by other participants of the ecosystem, such as the retailer Bright Food. Similar concepts are being developed by the company Haier, producing home appliances with the idea of building an internet of clothing ecosystems, where owners of Haier washing machines are rewarded by the correct use of the machine.

Haier is trying to attract clothing brands into this ecosystem to enable a fully automated service where tagged products are recognized by the machine, which then selects the appropriate detergent and programme. Governments are also looking at this concept, most notably the Republic of San Marino, which is deploying a carbon ecosystem for their citizens that leverages e-mobility, green energy, waste management and more as the means for the users to be rewarded for positive behaviour.

The examples above show the potential of disruption of blockchain technology in different industries, highlighting its role as a fundamental layer of a new Internet economy where blockchain represents a novel protocol for future use cases. The role of a fundamental layer is less evident in B2B markets, but developments are taking places in nearly all industries.

Power and renewables.

Oil and gas. Other sectors. Letter from the CEO. Remi Eriksen. However, there is an argument that a degree of technical awareness and or embrace of disintermediation motivations means that it is by default partially excludable. Public blockchains can develop smart contracts and other applications allowing increasingly complex transactions to occur on them.

This may provide opportunities for a more fundamental change in the economy, which is a questioning of the very necessity of the firm as a structure managing workers, or at least shrink the boundaries of a firm significantly. This may in turn impact the strategy of existing firms in relations to their own workers. Public blockchain in theory provide for these types of consortia but they have yet to be realized in the real-world in the same way as consortia blockchains such as in banking or supply chain management. Public blockchains are those that any person can access, contribute code to and anyone can read any of the transactions in the blockchain.

Public blockchains, such as Ethereum or Bitcoin are co-developed as open source software projects that allow separate companies to co-develop a common technical platform. In this sense, separate individuals or companies form a technology collaboration that co-creates a common resource for usage and benefit Nakamoto, Those benefits are usually separately accrued i. Companies are building a loosely coupled alliance based on, e. These are therefore strongly associated with asset specificity and economies of scale except that these are done outside of the normal boundaries of the firm.

There are few non-digital analog examples that conform to these types of systems. These platforms are to some extent non-rivalrous but are to a certain extent excludable — to co-create such a system, companies or individuals must buy into the overall blockchain platform ideology e. Those that do not do that either are not able to join the platform or must develop their own project; this explains to some extent the plethora of new types of public blockchain from a variety of different technology consortia; those that believe in blockchain for IoT IOTA or blockchain for AI among others.

Boundary Spanning in a Digital World: The Case of Blockchain

Smart contracts provide a mechanism for control and co-ordination. Consortia blockchains bear only little resemblance to public blockchain; the technology behind may be similar, but the governance principles are very different. Since a consortium blockchain is held by a handful of companies, the question of determining responsibilities and tracking transactions is much less an issue than with public blockchain. However, setting up a consortium blockchain could be a very efficient way to organize cooperation between already existing firms, notably because it reduces coordination costs greatly.

Of greater importance to such consortia, therefore, are the rules of engagement, voting mechanisms and how transparency is implemented toward, e. Private blockchains, however, require a different approach —to effectively develop such a platform, companies need to form a consortium that is often spun out as a joint venture between all of them. Private blockchains therefore moving the boundary spanning mechanisms of MNCs beyond information sharing into the actual production processes themselves.

Firms form such consortium to control or manage market failure Hirschman, ; companies form an alliance based on smart contracts and through working together to create a combined firm boundary that allows all of them to benefit and make the market work better for them. Within such consortia there is strong ideological agreement around the issues that affect proper market functioning.

In order to keep our analysis focused, we have concentrated solely on the impact of blockchain on the boundaries of the firm and the creation of a new type of boundary mechanism that needs further analysis and empirical testing. In addition, the types of forms of governance mechanisms most effectively used within blockchains is an area that will provide critical insights into their management and operators for strategy scholars and practitioners.

We have not had space to analyze how blockchain affects the existing types of relationships such as networks or ecosystems — empirical testing of the difference in transaction cost effects of these different market structures may provide fruitful insight for scholars.

There are several implications for managers as a result of our analysis. Firstly, the choice of whether to use blockchain is more complicated than it first appears — in order to glean the highest value from such an activity it is critical to ensure that a sufficient number of other companies are able to join the consortium in order to ensure sufficiently low cost of membership versus benefits gained. Managers need to decide if a public or private consortium blockchain is the correct one for their needs and if so, which boundaries are the best ones to blur for their particular product or service delivery.

Selection of consortium partners will also be critical. In contrast to other technical solutions, the legal design of the blockchain in question needs to precede any implementation work. Ostensibly much of blockchain may appear to be about reducing transaction costs, but it is often about a strategic response to a perceived market failure and an attempt to make the market work better for all the companies in question through consortia; managers working with blockchain therefore also have to recognize that companies are better able to work with companies in consortia that have similar competencies rather than as usual compete.

Listen to Money talks: The trust machine now.

This is very different to established strategic theories around, e. Finally, where strategy has often relied on building resources from the inside out — i.

- bitcoin controversy in india!

- Recent Posts!

- Frontiers | Boundary Spanning in a Digital World: The Case of Blockchain | Blockchain.

- asic bitcoin miner worth it?

- From Bitcoin to blockchain.

- Top Podcasts In Business News;

We hypothesize that there is regulatory divergence between the production and innovation alliances. They cannot be regulated on a per firm basis — blockchains may require sectoral regulation.

- sell bitcoin to paypal canada!

- Demystifying Cryptocurrencies: A Primer | Avantis Investors!

- bonus bitcoin hack;

- Web 3.0: What’s blockchain and why should you be paying attention to it?.

- como baixar carteira bitcoin.

- canadian dollar to bitcoin converter.

Focusing on our two cases, namely, private vs. Private or consortium blockchains, so far, are composed of already existing and established companies, which are associated with a service company developing the blockchain. So, sectoral regulation applies, because generally, member companies are of the same sector. For example, banking regulation should apply to R3, or transport regulation should apply to supply chain consortia. This reasoning may, however, not apply to consortium blockchains that integrate an industrial sector both horizontally and vertically.

When firms acting at different stages of the market participate in one single blockchain infrastructure, discrepancies between legal and economic status may render sectoral regulation inefficient and require the introduction of blockchain-specific rules, the application of more generally applicable legal provisions, or a combination of the two. Another issue for regulation is the determination of legal liability.

Bitcoin trading without investment

In a private or consortium blockchain, companies could be collectively responsible, rather than individually, for certain functions of their global operation. Does this amount to collusion between autonomous undertakings or is there joint market risk created from blockchain consortia? This is something regulators may need to provide clarity on. PG is an extremely close collaborator and contributed in depth to the work in this manuscript.

AB is a close collaborator and has contributed in depth to the work in this manuscript. All authors contributed to the article and approved the submitted version.

- Review: In Boosting Blockchain, ‘Trust Machine’ Chains Itself In.

- Bitcoin, blockchain and cryptocurrencies!

- time duration of btc;

- tradingview idea bitcoin?

- precio bitcoin en julio 2021.

- The trust machine.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest. The authors would like to acknowledge Dr. Gurguc for discussions on boundaries of the firm. Afuah, A. Redefining firm boundaries in the face of the internet: are firms really shrinking? Google Scholar. Aldrich, H. Boundary spanning roles and organization structure. Ancona, D. Bridging the boundary: external activity and performance in organizational teams. Antonopoulos, A.

Mastering Bitcoin: Unlocking Digital Cryptocurrencies. Bakos, J. Reducing buyer search costs: implications for electronic marketplaces. Barney, J. Firm resources and sustained competitive advantage. Bartlett, C. The Transnational Solution. Boston: Harvard Business School. Beck, R. Blockchain technology in business and information systems research. Benkler, Y. Birkinshaw, J. Boundary spanning activities of corporate HQ executives insights from a longitudinal study.

Braendgaard, P. Brynjolfsson, E. Does information technology lead to smaller firms? Buchanan, J. An economic theory of clubs. Economica 32, 1— Castells, M. The Rise of the Network Society. Oxford: Blackwell Publishers.

With web 3. Figure 1. The impact of technology on the boundaries of the firm has been investigated with some interest in various streams of literature. This reasoning may, however, not apply to consortium blockchains that integrate an industrial sector both horizontally and vertically. This is furthering the development of alliances — where firms can utilize technology to manage and control the most efficient boundaries — specifically, we posit a new boundary for transaction costs that firm strategies are indicating — the digitally enabled consortia, as illustrated in Figure 2 below. Keywords : blockchain, strategic alliances, transaction costs, boundary spanning, digitalization. These strategies can include, e.

Catalini, C. Chiles, T. Coase, R. The nature of the firm. Economica 4, — Cornes, R. Cretin, A. Cusumano, M. De Filippi, P. Blockchain and the Law : The Rule of Code. Dunning, J. Reappraising the eclectic paradigm in an age of alliance capitalism. Bus Stud. Elster, J.

Trust and Emotions.

Blockchain as a Technology

Oslo: Novus Forlag. Fleming, L. Brokerage, boundary spanning, and leadership in open innovation communities. Fukuda, K. Science, technology and innovation ecosystem transformation toward society 5. Grossman, S. The costs and benefits of ownership: a theory of vertical and lateral integration. Halaburda, H. Blockchain revolution without the blockchain. ACM 1, 27— Henderson, R.

Measuring competence? Exploring firm effects in pharmaceutical research.