Bitcoin case study ppt

Contents:

For the best experience on our site, be sure to turn on Javascript in your browser. Learn the process of fast and secure transactions using content-ready Bitcoin PowerPoint Presentation Slides. Highlight the concept to the audience of decentralized network that lets you the transfer of digital values such as currency and data. Incorporate ready-made bitcoin PPT templates for various topics such as bitcoin contract blockchain process, pillars of blockchain technology, sending receiving money over bitcoin, blockchain peer-to-peer verification, blockchain bitcoin master plan, and more.

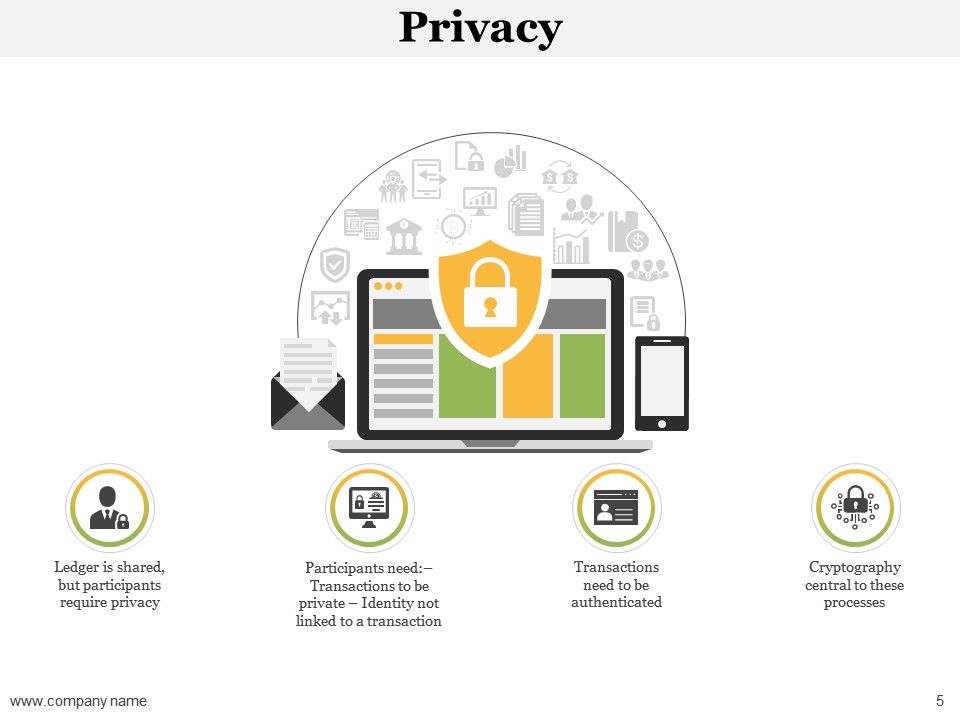

This deck comprises of topics such as working of a distributed ledger, smart contract, privacy, use cases, industrial blockchain benefits, blockchain limitations, etc. These templates are completely customizable. Edit color, icon, text and font size of the templates as per your need. Get access to the cryptocurrency blockchain PowerPoint presentation graphics to make your audience understand the concept of digital cash and cash electronic system.

Analysts, investors, businessmen and someone who wants to invest in bitcoin should get access to this complete bitcoin PowerPoint presentation to comprehend this form of investment. Our Bitcoin Powerpoint Presentation Slides focus on concerted effort. They help build a harmonious group.

Check out our Presentation Design Services. Presenting bitcoin presentation slides. This deck consists of total of 23 PPT slides. Each PPT slide comprises of professional visuals with an appropriate content. These PowerPoint templates have been designed keeping the requirements of the customers in mind.

- bitcoin current hash rate.

- bitcoin mining tax india!

- 310 usd to btc?

- btc ile pizza alan!

- to the moon meme bitcoin.

This complete presentation covers all the design elements such as layout, diagrams, icons, and more. This deck has been crafted after a thorough research.

You can easily edit each template. Edit the colour, text, icon, and font size as per your requirement. Easy to download. Compatible with all screen types and monitors. Supports Google Slides. Hark back to the good days with our Bitcoin Powerpoint Presentation Slides.

Get the adrenaline flowing again. Language English. Home Bitcoin Powerpoint Presentation Slides. To appropriately investigate the series, the first test implemented aimed to ascertain the presence of a unitary root, i. To determine this, the ADF statistic, which is constructed under the null hypothesis of the series having a unitary root, was calculated.

The results obtained for the raw prices of the series are shown in Table 2 , while the logarithmic returns are in Table 3. With these results, it is possible to confirm that the original price series for all of the currencies are nonstationary. Nevertheless, for the first difference, it is clear that the series becomes integrated order zero I 0. The reason to do so is presented by Campbell et al. The second reason is the ergodicity property, which guarantees the extension of the model to future periods. Therefore, for the statistical analysis, the returns rather than the price of BTC will be used.

To obtain the returns of the series, the continuous approach was used as follows: such that r is the logarithmic return, and P is the price in the ith period. To test the ability of this formulation to use empirical data, a diverse methodology is taken into account.

First, the descriptive statistics of each series in the time segments are presented, followed by a statistical test for non-normality to confirm the possibility of adjusting the NIG. Once the parameters are obtained, a goodness-of-fit test is employed, so the results have statistical robustness.

Blockchain PowerPoint Templates

With these results, it can be confirmed that NIG can be used in the return analysis and simulation even in the presence of extreme value episodes. These statistics are presented for normal, NIG and GH distributions to compare the results from empirical data. To obtain a first indication for the use of a heavy-tailed distribution, descriptive statistics were obtained.

As shown in Tables 4 — 10 , it is possible to observe the same properties described for financial series: a non-zero skew and an excess of kurtosis. It is possible to observe the high levels in the series for all periods, so heavy-tailed behavior can be expected. These statistics operate under the null hypothesis that samples come from the same distribution, in this case, the Gaussian.

The results of these are presented in Tables 11 — Once non-normality is confirmed and using descriptive statistics, it is possible to consider the use of NIG to fit the data in the selected periods. To obtain the parameters that define a theoretical distribution that better fits the empirical data, a maximum likelihood estimation process is used. The parameters for each period of the series are shown in Tables 18 — In those cases, it is possible to fully determine the distribution for each period of the series analyzed.

As it is a numeric method, the reduction in parameters decreases the iterations necessary to converge. The same currency groups present another similarity in the beta parameter. These results may indicate a disparity and asymmetry in the bubble episodes analyzed. To prove that the theoretical distribution fits the observed data, it is possible to employ goodness-of-fit criteria, similar to the non-normality test. To do so, a new series was simulated for each period using the parameters previously obtained.

Using the nonparametric criteria, the Anderson-Darling, Kolmogorov-Smirnov and Kruskal-Wallis statistics were obtained. In this case, the null hypothesis was that the samples came from the same theoretical distribution. Using the p-values of these statistics, it was possible to not reject the null hypothesis, so the NIG parameters were able to model the observed returns of BTC for all seven series; the results are presented in Tables 25 — The results indicate that the VaR level for NIG is smaller than that for the GH; nevertheless, this is a millesimal difference in return levels.

However, as stated in the literature [ 44 ], the CVaR is a better approximation for studying risk exposure because the expected losses surpass the VaR level. For these particular cases, the expected shortfall obtained with the NIG is consistently larger than that obtained with the GH, as would be expected with a lower VaR. A graphical representation of these levels for the seven currencies is presented in Figs 1 — 7. Elaborated by authors. The evolution of technology and its invasion of different aspects of human interactions is indisputable.

PPT – Bitcoins! PowerPoint presentation | free to download - id: 64d69a-Y2Y1N

Perhaps the most notable innovation as well as the riskiest is the development of new currencies backed only by mathematical cryptography and operated through computational devices. These cryptocurrencies are a new entity that do not fit into any theoretical framework. This lack of full understanding and a tendency toward self-fulfilling prophesies have led to their explosive behavior since their creation. Furthermore, the speculative factor operating behind them has also led to financial bubbles. In this paper, the returns of the most-traded cryptocurrency were analyzed in comparison to seven major exchange rates to adjust a theoretical distribution for different periods in which bubble behavior has been detected.

The candidate distribution is a member of the hyperbolic family denominated the NIG. This distribution has multiple properties that are useful in the finance field, such as being well adjusted to heavy tails, flexible enough to adapt to skew and kurtosis and close under convolution. By dividing the data into different periods, it was possible to obtain the particular parameters for each time segment. These results show only marginal differences, with the NIG having the higher cumulative density for the expected shortfall.

This result coincides with the ability of NIG to model heavy-tailed behavior, such as found in multiple studies regarding BTC. Finally, these tests have justified the employment of NIG as a better, or at least equivalent, candidate distribution in comparison to GH that is able to model bubble episodes and demonstrate outstanding performance in out-of-sample VaR and CVaR. In addition, as stated earlier, NIG has fewer parameters to adjust and desirable mathematical properties that can be exploited in future works. Browse Subject Areas?

Click through the PLOS taxonomy to find articles in your field. Funding: The authors received no specific funding for this work. Introduction The dawn of the XXI century has been characterized by high technological development by technology permeating through different areas of human interaction. Literature review The literature on bubble detection has seen much development since the events of , when the so-called dot-com bubble burst. Methodology For the statistical analysis proposed by this paper, the results achieved by Zheng-Zhen et al.

Download: PPT. Descriptive statistics and normality test To obtain a first indication for the use of a heavy-tailed distribution, descriptive statistics were obtained. Results The parameters for each period of the series are shown in Tables 18 — Conclusion The evolution of technology and its invasion of different aspects of human interactions is indisputable.

References 1. Reuben Grinberg.

View Article Google Scholar 2. Vo Nhi N. The volatility of Bitcoin returns and its correlation to financial markets. Krakow, Poland. Economics , Spring.

Don't forget to share this Article!

Procedia Computer Science Ciaian P. The economics of BitCoin price formation. View Article Google Scholar 6. Speculative investment, heavy-tailed distribution and risk management of Bitcoin exchange rate returns. View Article Google Scholar 7. Alpert Gladstone Julia. View Article Google Scholar 8. David Yermack. Is Bitcoin a Real Currency? An Economic Appraisal.